Algorithmic trading is growing rapidly, with the global market projected to reach $26.8 billion by 2028, exhibiting a CAGR of 12% from 2023 to 2028. These strategies leverage algorithms to automate trades based on predefined rules, enabling traders to navigate complexities and seize opportunities.

Evaluating performance through metrics like Sharpe Ratio and Maximum Drawdown is crucial. MetaTrader offers a platform to engineer algorithmic strategies, unleashing their true potential.

Table of Contents

Unleashing the Power of Advanced MetaTrader Algorithms

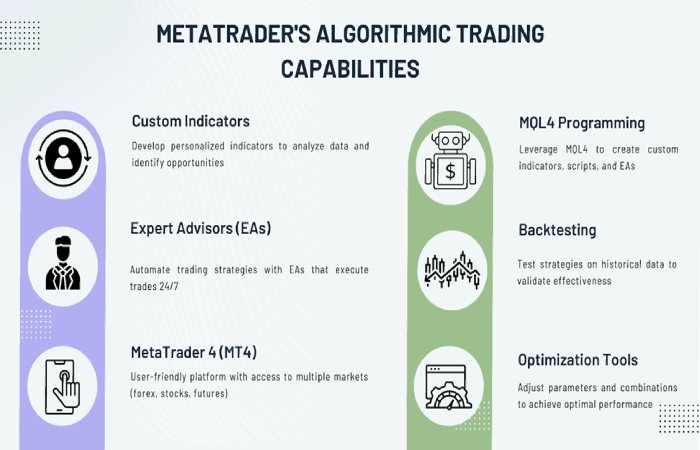

MetaTrader provides a wide range of tools for traders to create advanced algorithms tailored to their unique trading strategies. Whether developing custom indicators or building sophisticated Expert Advisors (EAs), the platform offers a flexible environment to bring algorithmic trading ideas to life.

Crafting Bespoke Indicators and Expert Advisors

One of MetaTrader’s strengths is its flexibility in allowing traders to develop custom indicators that align with their trading approach. These custom indicators can provide valuable insights by analyzing historical data and market patterns, helping traders make informed decisions and identify potential opportunities.

Expert Advisors (EAs) take automation even further. By developing MetaTrader indicators and EAs, traders can encode their trading rules and strategies into an algorithmic system that executes trades automatically. This not only ensures consistency by removing human emotions but also enables 24/7 market monitoring and real-time trade execution.

MetaTrader 4: A Powerful Trading Platform

MetaTrader 4 (MT4) is a widely adopted trading platform known for its user-friendly interface and robust functionality. It provides access to a wide range of financial markets, including forex, stocks, futures, and more. While MetaTrader 4 offers numerous built-in indicators and tools, its true power lies in its ability to customize and automate trading strategies through its powerful programming language, MetaQuotes Language 4 (MQL4).

Traders can leverage MQL4 to create custom indicators, scripts, and Expert Advisors tailored to their specific needs. This flexibility allows them to incorporate advanced algorithms, technical analysis techniques, and risk management strategies into their trading approach.

Backtesting and Optimization: Fine-Tuning for Success

Before implementing any algorithmic strategy, it’s crucial to backtest and optimize it thoroughly. Backtesting MetaTrader strategies on historical data helps validate their effectiveness and identify potential weaknesses. This step allows traders to fine-tune their algorithms and gain confidence in their strategies before risking real money.

MetaTrader’s optimization tools enable traders to systematically adjust parameters and test various combinations to achieve optimal performance. By continuously refining and enhancing their algorithms through automated optimization, traders can maximize profitability while minimizing risks.

Integrating AI and Machine Learning for Predictive Analytics

As algorithmic trading evolves, integrating artificial intelligence (AI) and machine learning techniques has become a game-changer. MetaTrader AI integration allows traders to leverage advanced predictive analytics, unlocking new dimensions of market analysis and forecasting.

By training machine learning models on large datasets, traders can identify intricate patterns and trends that may be difficult to detect using traditional analytical methods. These insights can then be seamlessly incorporated into trading algorithms, enabling traders to make more informed decisions and capitalize on market movements with greater accuracy.

Take a look at some popular AI/ML techniques for algorithmic trading and their potential applications:

| Technique | Potential Applications |

| Neural Networks | Forecasting price movements, identifying complex patterns |

| Decision Trees | Generating trading signals, rule-based decision making |

| Genetic Algorithms | Optimizing trading parameters, portfolio optimization |

| Clustering Algorithms | Identifying market regimes, asset classification |

Mastering Risk Management for Algorithmic Trading

While algorithms offer speed and efficiency, managing risk is crucial for successful algorithmic trading strategies. MetaTrader provides tools to implement robust risk management, ensuring strategies are not only profitable but also resilient to market volatility.

Techniques like dynamic stop-loss orders, position sizing, and portfolio diversification can be integrated into trading algorithms to protect capital and mitigate losses. By finding the right balance between risk and reward, traders can confidently navigate even turbulent market conditions.

Achieving High-Speed Trading with MetaTrader

In today’s fast-paced trading environment, speed is essential. High-speed trading MetaTrader solutions allow traders to execute trades with lightning-fast precision, minimizing latency and ensuring they never miss lucrative opportunities.

By optimizing connectivity and execution, traders can use real-time trading algorithms that continuously monitor market conditions and react instantly to emerging trends and patterns. This real-time responsiveness maximizes profitability and provides a competitive edge in an ever-changing market landscape.

Continuous Monitoring and Adaptation

While algorithmic trading offers advantages, markets are dynamic, and successful strategies may become obsolete over time. To maintain a winning edge, traders must be prepared to continuously monitor and adapt their algorithms.

MetaTrader predictive analytics tools provide insights into the performance of trading strategies, enabling traders to identify potential weaknesses or areas for improvement. By embracing an iterative approach, traders can refine their algorithms to remain relevant and effective in changing market conditions.

Scaling and Diversifying for Optimal Portfolio Performance

One advantage of algorithmic trading is the ability to scale and diversify strategies with relative ease. Once a trader has developed a successful algorithm, they can scale it up, increasing trade volumes and profitability.

Furthermore, by diversifying their portfolio with multiple winning trading strategies in MetaTrader, traders can mitigate risk and capitalize on a broader range of market opportunities. This diversification ensures a more consistent stream of returns and provides a safety net against potential losses in any single strategy.

Navigating Legal and Ethical Considerations

While algorithmic trading offers benefits, it’s essential to navigate legal considerations in MetaTrader trading carefully. Regulatory bodies have implemented rules and guidelines to ensure fair and transparent market practices, and traders must ensure their algorithms comply with these regulations.

Additionally, ethical considerations play a crucial role in algorithmic trading. Traders must ensure their strategies do not engage in manipulative or predatory practices, as these not only violate regulatory frameworks but also undermine market integrity.

By adhering to legal and ethical standards, traders can maintain a positive reputation and contribute to the overall health and stability of financial markets.

Addressing Common Queries

How can I determine the effectiveness of my custom algorithm in MetaTrader before going live?

Backtesting and paper trading are essential steps to validate the performance of your algorithm before deploying it with real capital. MetaTrader offers robust backtesting tools that allow you to simulate trades using historical data, enabling you to assess the algorithm’s performance and make necessary adjustments. Additionally, many brokers offer demo accounts, providing a risk-free environment to test your algorithms in real-time market conditions.

What are the most common pitfalls in algorithmic trading, and how can I avoid them?

Overfitting, neglecting risk management, and underestimating software and hardware requirements are among the most common pitfalls in algorithmic trading. To avoid these, it’s crucial to thoroughly backtest your algorithms, incorporate robust risk management techniques, and run on appropriate trading infrastructure. Additionally, continuously monitoring and adapting your strategies to changing market conditions is essential.

How frequently should I review and adjust my trading algorithms?

There is no one-size-fits-all answer to this question, as the frequency of review and adjustment depends on various factors, such as the trading strategy, market conditions, and the algorithm’s performance.

However, it’s generally recommended to regularly monitor your algorithms’ performance and be prepared to make adjustments as needed, particularly when market conditions change significantly or when your strategy’s performance deviates from expectations.

Embrace Algorithmic Trading with MetaTrader

Integrating algorithmic strategies with MetaTrader offers traders a winning edge in ever-changing financial markets. Leveraging the platform’s advanced capabilities allows engineering smart techniques, streamlining processes, and capitalizing on inefficiencies with unparalleled speed and precision.

However, success demands a deep grasp of market dynamics, continuous learning, and adaptability. Embracing the principles outlined ensures navigating complexities, mitigating risks, and staying ahead in this revolutionary trading approach.